SD-WAN Market Share Shifts & Why Do They Matter?

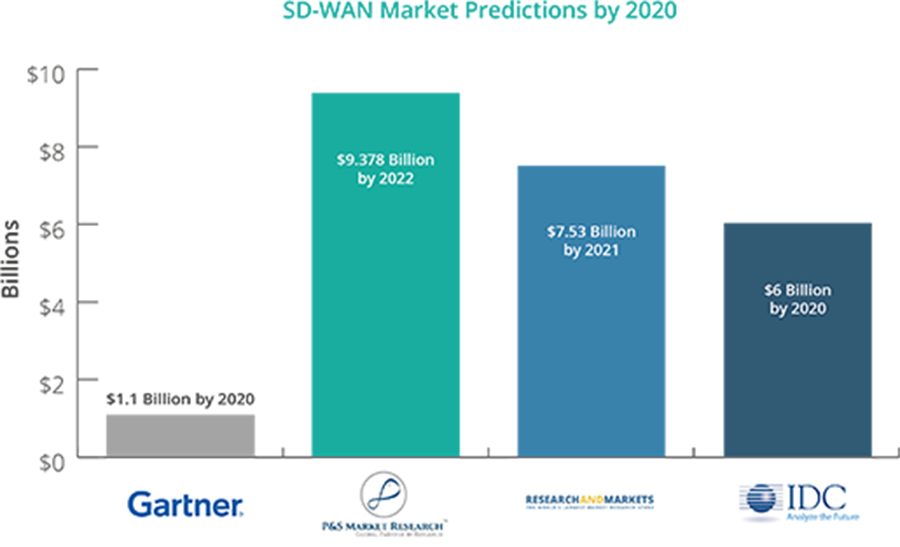

The SD-WAN market was always expected to become a major force in networking, and it’s been exceeding expectations in the best way possible. As Software-Defined WAN continues its successful march and enters the growth stage of the product lifecycle, let’s look at the predictions by key industry analysts, and what the numbers have to say.

SD-WAN Market Share

According to the 2019 Q2 Data Center Network Equipment Market Tracker from IHS Markit, Aryaka held 3rd place in the SD-WAN market, just behind two much larger vendors, VMware and Cisco. Other noteworthy trends include:

- Gartner predicts the SD-WAN Managed Services market to expand with a CAGR 76.1% to $5.7B in 2023.

- The top three markets are Western Europe, North America and Japan

- Triple digit growth (CAGR) forecasted for Latin America, Middle East & Africa

- IDC speculates that the SD-WAN infrastructure market is poised to reach $5.25 Billion in 2023.

- A report by Futuriom expects the market for SD-WAN tools and Network-as-a-Service (NaaS) (non-legacy service provider) to reach $1.5 billion in revenue by 2019 and $2.5 billion by 2021.

- According to Reportlinker, the global SD-WAN market size is expected to grow from USD 1.0 billion in 2018 to USD 4.1 billion by 2023, at a CAGR of 32.7%

How does one justify such different valuations of the same market? Well…It can vastly be attributed to the fact that different vendors have different perceptions of the SD-WAN mechanism.

Define SD-WAN

Different vendors — different definitions. But before we get into what is SD-WAN, let’s try to understand, ‘why’ SD-WAN?

As the application delivery mechanism drifts towards ‘as-a-service’ model, mobile and IoT devices proliferate, the cloud goes hybrid and various other progressive trends dominate the enterprise landscape. In essence, the traditional WAN is failing to keep up with this dynamic, internet and cloud-based ecosystem. This creates a profound sense of urgency to re-think the WAN, because businesses need more than just raw bandwidth to get the job done.

Enter SD-WAN, converting the dumb data pipes into a logical, virtualized path that can dynamically adapt to network conditions and can be intelligently managed to route traffic through optimal physical network connections.

SD-WAN services and equipment come in all shapes and forms today. As the market grows ripe, competition gives way to innovation and today no two vendors are exactly alike. There are various considerations and trade-offs to be kept in mind while choosing the options and solutions that you expect to meet your modern networking needs.

SD WAN Market: Not All SD-WANs Are Created Equal

If P&S Market Research, Research and Markets, and IDC are to be believed, the high evaluation of the SD-WAN industry can be attributed to the colossal amount of hardware required to manage the service. Gartner was among the first to spot it when they said: “Many SD-WAN deployments today haven’t actually replaced traditional routers; they’ve supplemented them for a variety of reasons, including risk aversion and lack of support for legacy T1/E1 interfaces.”

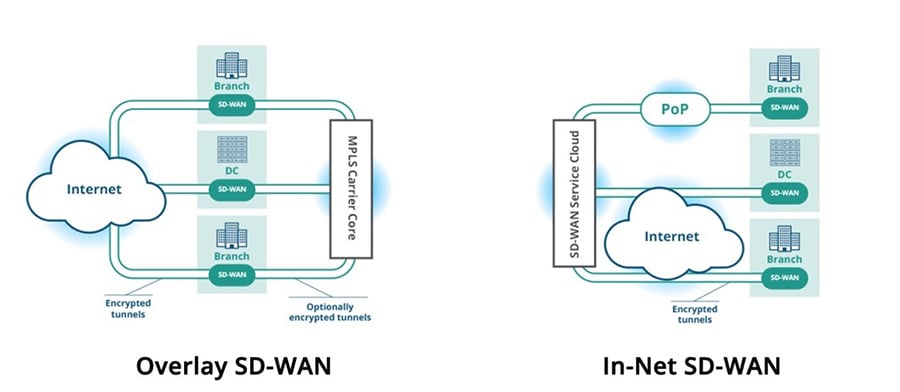

Take Overlay SD-WAN for instance. This is designed to deploy and manage the network from a central location, by installing edge devices that can also replace WAN routers in the branch offices. The SD-WAN software controller brings together the low-cost ISP circuits into a ‘pipe’ with enhanced performance and availability, followed by creating an overlay WAN with in-depth application visibility, allowing businesses to dynamically steer their application routing.

However, some vendors who follow this model add an additional box instead of replacing the existing router. This calls for an expansion in your budget for accommodating the hardware, and its maintenance and monitoring.

The other model is the In-net SD-WAN. Though it covers the middle-mile and can be delivered via “cloud-based OTT” model, most vendors lack the infrastructure required to support this technology. The in-net model provides its own WAN, optimizing the middle mile, and allowing organizations to route data between the branch sites and cloud environment based on the policies you define in the SD-WAN’s user interface. New functionalities can be delivered via the cloud, without asking users to upgrade hardware.

The In-net model is slightly more expensive than the Overlay SD-WAN model, but is ideal for large enterprises with high data confidentiality needs. The only way this model might not work for you is if you have very specific network needs and you need specific topologies tailored to your unique demands, or if you have a few sites and there is not much inter-site communication. Under the following circumstances you might prefer to install and configure the devices at each site individually, as opposed to a ‘as-a-service’ model.

SD-WAN Growth: Going Global

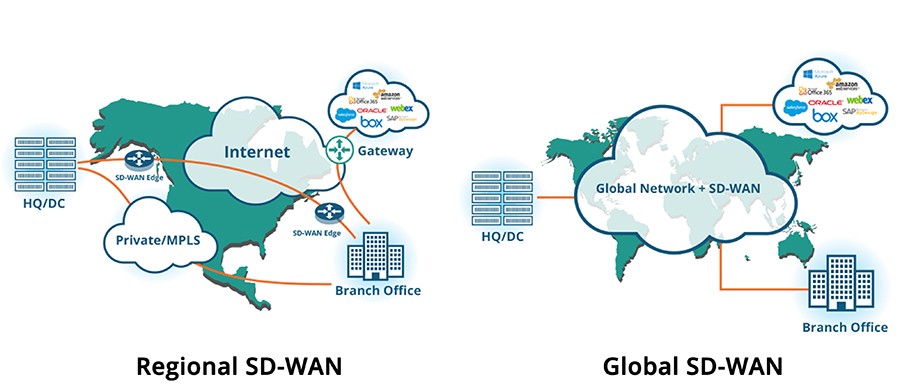

The bulk of SD-WAN solutions were designed for regional deployments and mostly fail when it comes to supporting a global workforce. The problem stems from the fact that most SD-WAN tools use the public internet for long-haul connections between end-points. Why the internet? Because it enables you to scale your WAN more quickly and more cost-effectively, something than couldn’t be achieved with MPLS.

Appliances are installed in branch offices and virtualize the network edge by connecting to both the legacy MPLS backbone and the public Internet. The appliances are application-aware and route traffic over one WAN pipe or the other based on link conditions and pre-set priorities.

The real challenge surfaces when offices try to collaborate and communicate in real-time or try to connect to applications hosted in other geographies. Regional SD-WAN just fails to keep up.

The key to supporting global outposts is finding an SD-WAN that is delivered as a service over a managed private backbone instead of using the public Internet; a private network for businesses layered with WAN Optimization software and all the intelligence in the middle-mile and the edge.

Regional SD-WAN suffices as long as businesses do not expand overseas or operate out of remote geographies. For enterprises with expansion on the cards or a globally dispersed workforce, global SD-WAN is the answer to all the application performance woes.

SDWAN Deployment Models

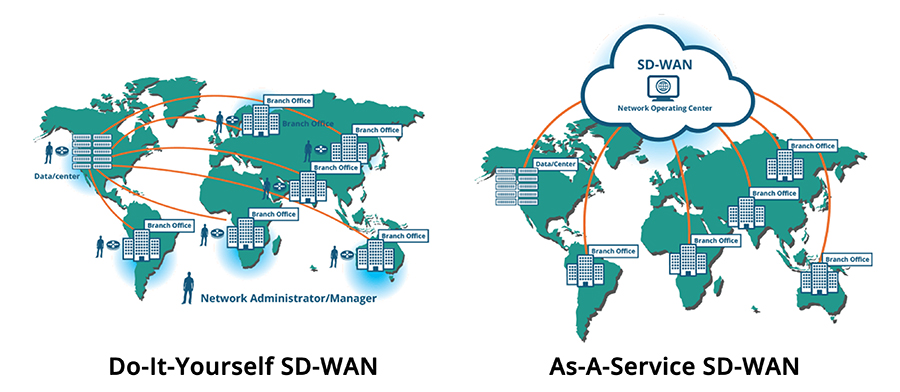

The main unique selling point of SD-WAN is that it lets you use multiple WAN links simultaneously. While this carrier diversity enables better business continuity, as you can always purchase link from a different carrier in case the first provider is having issues, it also means more hassle in adding new branch offices and managing more resources. Multiply this with hundreds of sites that you might will have to deploy down the road, this can be a significant upfront cost when taking the DIY approach to SD-WAN deployment.

If you are a global multi-national who can afford to have in-house expertise to manage these networks, the DIY approach might work for you. But, if you are a mid-size company looking to leverage SD-WAN, then as-a-service model might be more suited to your needs.

In the as-a-service, the solution is fully integrated. WAN management is taken care of by the as-a-Service SD-WAN provider, freeing up IT resources and budget for other projects.

Bottom-line

As enterprises look to gain more control over their networks, they are eventually coming to terms with the fact that SD-WAN might be a bit more complicated than they thought, especially with so many options and vendors. What they must look for is a partner that can make the SD-WAN transformation as fluid as any other managed service. Businesses want reliable, high-performing connectivity and they want it delivered in a reasonable timeframe and equitable price.

Aryaka’s global SD-WAN is also delivered as a service, so you don’t have to buy, configure, deploy, or maintain expensive WAN Optimization boxes in every single location. This approach delivers cloud and SaaS applications to global end-users as if those applications were living in the local corporate data center and can be deployed in a matter of hours, instead of months or years.