Digital Transformation and Cloud Migration Drive SD-WAN Market Growth

Unless your global enterprise still operates using Morse code, there has probably been some major buzz in your IT department around the cloud, digital transformation, and of course, SD-WAN.

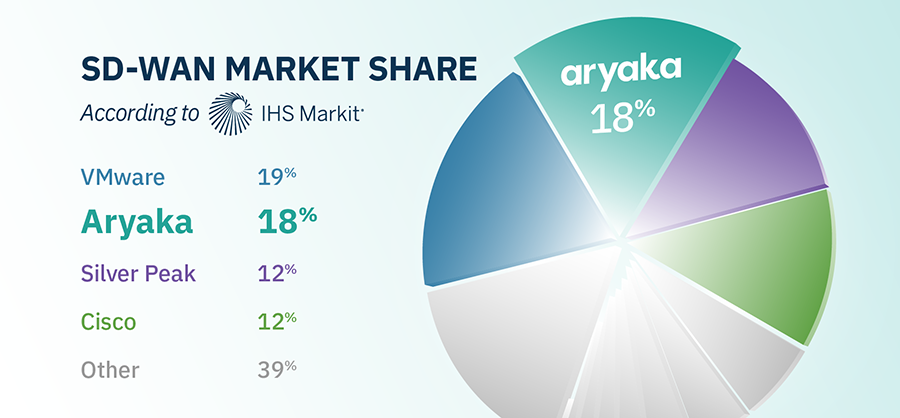

IHS Markit released their latest industry report, which noted the SD-WAN market grew 12% in Q1 2018. While legacy enterprises such as VMware and Cisco jumped into the game by acquiring Velocloud and Viptela respectively, Aryaka remained listed as the largest independent SD-WAN provider with 18% of market share, bringing us within 1% of VMware for the top position of all solution providers.

“SD-WAN continued to grow, driven by new customers across many enterprise verticals coupled with expanded existing customer deployments,” IHS Markit says in its new report, Data Center Network Equipment Quarterly Market Tracker. Noting that the first wave of SD-WAN supplier consolidation is behind us, the Market Tracker report for the first time included Viptela revenue under Cisco and VeloCloud under VMware.

Aryaka stands alone as the largest pure-play SD-WAN market leader with 18% share of revenue, representing a 6% lead over Cisco. VMware has 19% and Silver Peak came in at a distant third with 12%, a hair more than Cisco’s share. Independence is key to product innovation. Aryaka is focused on constantly improving its SD-WAN service, while companies like VMware and Cisco are striving to integrate acquired technologies into legacy portfolios. The latter exercise imperils the installed base of their SD-WAN customers.

The Maturing SD-WAN Market

IHS attributes SD-WAN industry growth to the market maturing and “a transition from early market adopters to mainstream buyers.” Those buyers are driven, of course, by megatrends such as:

- Digital transformation, which is leading to a reassessment of the current network and whether it provides adequate agility, cost efficiency, scale, and performance especially as applications proliferate and move to the cloud.

- Cloud migration, which requires a new approach to the network that connects enterprise branches and data centers to services hosted on public computing environments. IHS Markit says there is “significant traction in SD-WAN sales due to increased consumption of SaaS and IaaS services with enterprises using SD-WAN to optimize network traffic flow between multiple on- and off-premises data centers.” According to Aryaka’s State of SD-WAN Connectivity Report, already 50% of SD-WAN traffic is to and from cloud resources. For further proof, consider the growth of AWS and Azure businesses.

SD-WAN is the right tool arriving at the right time to solve the pressing problems of today.

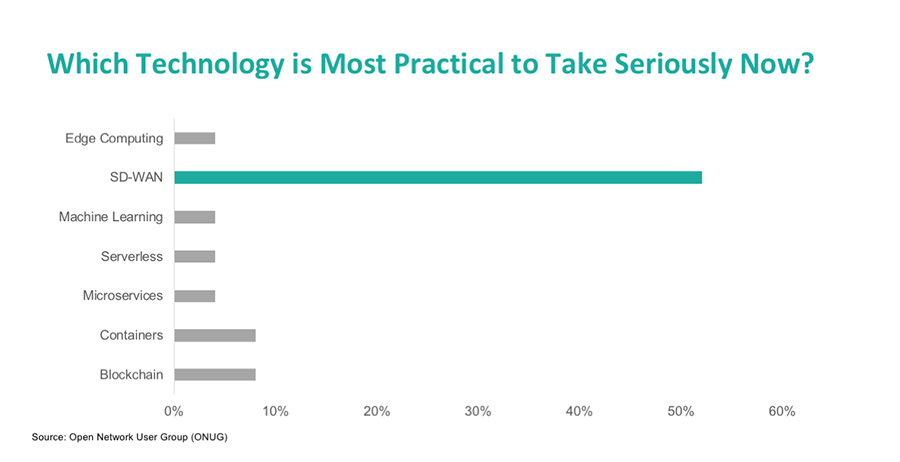

In a recent survey conducted by the Open Network User Group (ONUG), members were asked, “Which Technology is Most Practical to Take Seriously Now?” Participants overwhelmingly singled out SD-WAN, which got close to 55% of the votes in the poll. All other rated technologies, including containers and blockchain, got less than 10%.

The Core Differences in SD-WAN

Of the market share leaders in IHS Markit’s SD-WAN report, only Aryaka delivers SD-WAN as a service, a key differentiator that is contributing to the growth. Instead of delivering SD-WAN components and requiring customers to build their own solutions, Aryaka delivers SD-WAN as a service over a global, optimized, software-defined private network that simplifies and speeds deployment.

Besides being analogous the cloud consumption model, delivering SD-WAN as a service over private transport means Aryaka offers application performance that simply cannot be rivaled by SD-WAN product kits that use the public Internet for long-haul connections. The longer the Internet links, the more packet loss, and latency degrades the application experience.

That is why most SD-WAN deployments for even the market leaders in IHS Markit’s report tend to be regional wins:

- A grocery chain with 41 stores in one state

- A bank with 25 storefronts in two adjoining states

- A propane company with 10 locations

Compare that to Aryaka’s list of large enterprise customers with facilities around the world, including Samsung, Emirates Airlines, Cigna and Air China.

Enterprises that want to learn more about how Aryaka’s SD-WAN service compares to do-it-yourself SD-WAN kits can download “The State of SD-WAN Connectivity” report.

- Accelerate CAD/CAM Performance

- Improve Zoom Conferencing Performance

- Calypso Embraces a SaaS-first Strategy

- CallisonRTKL Transforms their WAN

- Kleinfelder Improves Application Performance

- Teradyne Transforms their WAN

- SAP web application performance

- Kleinfelder Improves Application Performance

- Industrial Manufacturing Company Transforms WAN